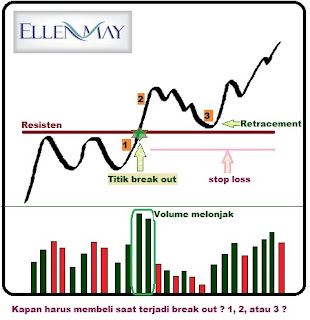

How Current Trading Breakout - For those who have mastered the technical analysis, must be familiar with the term break out, suport and resistance. Break out was a moment or event in the movement of stock prices, as stock prices through the roof area alias resistant.

Resistance is defined as a psychological price level to hold prices to rise further. Resistant like the roof. If a ball is thrown and hit the roof, then logically, the price will tend to fall. Therefore, market participants are usually cautious when a stock touched resistant area aka the 'roof' psychological.

For example, shares of ABCD, has a strong resistance area at Rp 5,000 per share. So

when prices neared the area, short-term market participants began to be

aware the price down because psychologically, the figure is vulnerable

to profit-taking.

However,

when the stock price apparently managed to get past the 5000

resistance, it is psychologically there was a break out alias roof

collapsed. The

break out or it could be called a burst resistant when accompanied by

high trading volume, it can provide a significant impact to the

continued strengthening of the stock price.Well, the question is now, how to trade when there is a break out? Traders often face a dilemma in answering it.

The point of the break out or broken roof depicted as green asterisks.If

we buy before the break out (area number 1), on one side of the action

is quite risky because not break out occurred despite visible symptoms.

But the plus side, when the break out is really the case then we should smile because we got a cheaper price.

Well,

when the break out is supported by high trading volume (indicated by

the bar chart volume jumps), then usually the price is rising fast. When there is a confirmed break out, prices are already well above the break point out, the image shown in number 2.

If

we buy in area number 2, the positive side, we certainly "can goods",

because a stock that breaks out sometimes move quickly and not

necessarily experienced or a retracement back to the point of break out

is. On the negative side, if we buy in point 2, we will get the shares at a higher price. Distance to stop loss level (pink line) was getting away, so when we moved stop loss point will experience substantial losses.

The

third strategy is to buy stocks break out when subjected to a

retracement or down for a moment to break out is the former area, which

has become suport or pedestal. Suport marks the break out will hold prices down further. Area No. 3 this is the best area to buy stocks break out. Why?Because

of the area's number 3 is already confirm stock break out, and by

buying in the area to this 3 trader will get a cheaper price, so the

distance to the stop loss level is not too far away. Thus, risks that may result will not be too big. But its shortcomings, not all stocks that break out will swing (retrace) or fall back to break out of his former area. The tendency of stocks that break out at high volume is usually potentially continue strengthening.

So, what should we do and what's the solution?The best solution is to buy in areas 2 and 3 with gradual. In this instance, the portfolio or a good money management will play an important role.

For example, you are 20% of your portfolio to purchase shares of ABCD is break out. You can buy in area 2 when the break out, a maximum of half of the money you allocate it (10%). Half of the remainder (10%) should you use to wait in area 3. Thus, the risk can be minimized. By using this method, we also will not "miss the train", and also obtained the average price is ideal.

Well, according to my trading tactics of trading in stocks break out. This strategy can also be applied to the commodity or forex trading. Trading should break out to do when markets are in a rising trend, and the trend is not flat (sideways) or even go down.

4.5

0 comments